Welcome to the ultimate guide to travel card 101 test answers! In this comprehensive guide, we’ll delve into the intricacies of travel cards, empowering you with the knowledge to make informed decisions and unlock the full potential of these financial tools.

From understanding the basics to maximizing rewards, we’ve got you covered.

Whether you’re a seasoned traveler or just starting to explore the world, this guide will provide you with the essential information you need to choose the right travel card, use it effectively, and stay protected while you travel. So buckle up and get ready to master the art of travel cards!

Understanding Travel Cards

Travel cards are financial tools designed to make international travel more convenient and cost-effective. They offer several benefits, including:

-

-*Reduced transaction fees

Travel cards typically charge lower fees for foreign currency transactions, such as ATM withdrawals and purchases, compared to regular credit or debit cards.

-*Competitive exchange rates

Travel cards often offer competitive exchange rates, ensuring you get more value for your money when exchanging currencies.

If you’re brushing up on your travel card 101 test answers, you might find some parallels in the iconic mural, the uprising by diego rivera . Both the test and the mural depict scenes of everyday life, albeit in different contexts.

Just as the test questions probe your understanding of travel card usage, the mural captures the essence of social and political struggles. So, while you’re studying for your test, take a moment to appreciate the art that reflects the complexities of our world.

-*Wide acceptance

Travel cards are widely accepted at ATMs, stores, and other merchants worldwide, providing flexibility and convenience during your travels.

There are different types of travel cards available, each with its unique features and benefits:

-

-*Prepaid travel cards

These cards are loaded with a specific amount of funds before your trip and can be used like a debit card. They offer the advantage of controlling your spending and avoiding overdraft fees.

-*Currency exchange cards

These cards allow you to exchange multiple currencies at once, eliminating the need to carry large amounts of cash or exchange currencies at multiple locations.

-*Travel credit cards

These cards offer rewards and benefits tailored to frequent travelers, such as frequent flyer miles, airport lounge access, and travel insurance.

Travel Card Features

When selecting a travel card, it’s crucial to consider specific features that align with your travel needs and preferences. These features encompass various aspects, including fees, exchange rates, rewards programs, and additional benefits.

Foreign Transaction Fees and Exchange Rates

Foreign transaction fees (FTFs) are charges levied by card issuers when using your card abroad. These fees typically range from 1% to 3% of the transaction amount and can add up quickly. Additionally, exchange rates offered by travel cards may vary from those offered by banks or currency exchange services.

It’s essential to compare these rates before choosing a card to minimize potential costs.

Rewards Programs and Benefits

Many travel cards offer rewards programs that allow you to earn points or miles on purchases. These points can be redeemed for flights, hotel stays, car rentals, or other travel-related expenses. Additionally, some travel cards provide perks such as airport lounge access, travel insurance, and concierge services, enhancing the overall travel experience.

Choosing the Right Travel Card

Selecting the ideal travel card requires careful consideration of several factors. Understanding your travel habits, budget, and specific needs is crucial to finding a card that aligns with your requirements. Here are some key aspects to consider:

Fees

Travel cards typically charge various fees, including annual fees, transaction fees, foreign exchange fees, and ATM withdrawal fees. It’s essential to compare these fees among different cards and choose one that fits your spending patterns. Consider how often you travel, the destinations you visit, and the amount of money you plan to spend.

Rewards

Many travel cards offer rewards such as miles, points, or cash back. These rewards can be redeemed for flights, hotel stays, merchandise, or other travel-related expenses. When selecting a card, compare the rewards programs and redemption options to determine which one offers the best value for your spending.

Benefits

Travel cards often come with additional benefits, such as travel insurance, airport lounge access, priority boarding, and free checked bags. Consider which benefits are most valuable to you and choose a card that provides them. For example, if you frequently check bags, a card that offers free checked bags can save you significant money over time.

Matching Card Features to Travel Needs

The key to choosing the right travel card lies in matching its features to your specific travel needs. If you travel frequently and spend a lot of money on flights and hotels, a card with generous rewards and benefits may be a good choice.

However, if you only travel occasionally and primarily for leisure, a card with lower fees and fewer rewards may be more suitable.

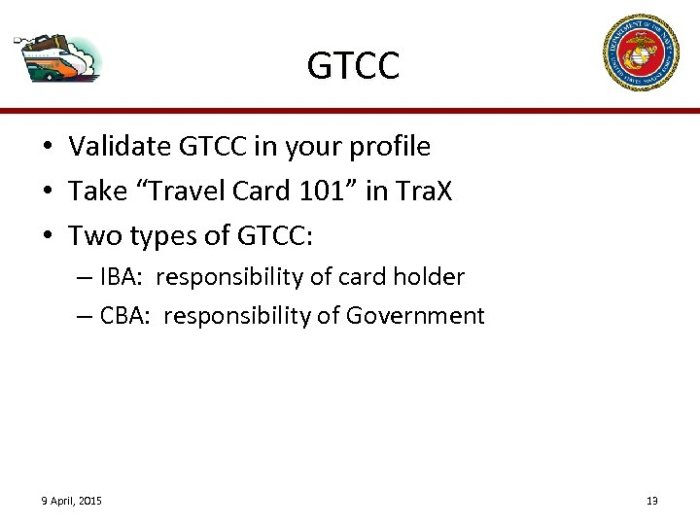

To assist in your decision-making, here is a table comparing different travel cards based on their fees, rewards, and benefits:

| Card | Annual Fee | Transaction Fee | Foreign Exchange Fee | ATM Withdrawal Fee | Rewards | Benefits |

|---|---|---|---|---|---|---|

| Card A | $95 | 3% | 3% | $5 | 1 mile per $1 spent | Travel insurance, airport lounge access |

| Card B | $0 | 2% | 2% | $0 | 1 point per $1 spent | Priority boarding, free checked bags |

| Card C | $295 | 1% | 1% | $3 | 2 miles per $1 spent | Travel insurance, airport lounge access, priority boarding, free checked bags |

By carefully considering the factors discussed above, you can choose a travel card that meets your specific needs and helps you maximize your travel experience.

Using Travel Cards Effectively: Travel Card 101 Test Answers

Maximizing the benefits of your travel card requires strategic use and a keen eye for opportunities. By implementing these tips, you can unlock the full potential of your travel card and optimize your travel experiences.

Avoiding Fees and Optimizing Rewards

Travel cards often come with a variety of fees, such as annual fees, foreign transaction fees, and ATM withdrawal fees. To avoid these fees, consider the following strategies:

- Choose a travel card with no annual fee or a low annual fee that you can justify with the benefits it offers.

- Use your travel card for all travel-related expenses, such as flights, hotels, and rental cars, to maximize rewards and offset any fees.

- Be aware of foreign transaction fees and use your travel card only in countries where the fees are low or nonexistent.

- Avoid using ATMs abroad, as withdrawal fees can be high. Instead, use your travel card to make purchases and withdraw cash from banks or currency exchange offices.

Using Travel Cards for Different Travel Scenarios

Travel cards can be used in a variety of travel scenarios to maximize benefits and enhance your experiences. Here are a few examples:

- For frequent travelers:A travel card with generous rewards and benefits, such as airport lounge access and priority boarding, can make frequent travel more comfortable and rewarding.

- For budget travelers:A travel card with no annual fee and low foreign transaction fees can help you save money on travel expenses.

- For business travelers:A travel card with corporate benefits, such as expense tracking and travel insurance, can streamline business travel and provide peace of mind.

By understanding the features of your travel card and using it strategically, you can maximize its benefits and make your travels more enjoyable and rewarding.

Travel Card Security

Travel cards offer convenience and financial protection, but they also come with security risks. Protecting your travel card from fraud and theft is crucial to ensure a safe and enjoyable trip.

Importance of Travel Card Security

Travel cards store valuable financial information, making them attractive targets for fraudsters. Unauthorized access to your card can lead to financial loss, identity theft, and ruined travel plans. Maintaining travel card security is essential to safeguard your finances and personal information.

Tips for Protecting Travel Cards

* Keep your card secure:Store your travel card in a secure location, such as a hidden wallet or money belt. Avoid carrying it in your back pocket or easily accessible areas.

Be aware of your surroundings

Pay attention to your surroundings when using your travel card, especially in crowded areas. Be cautious of anyone trying to distract or shoulder surf you.

Monitor your transactions

Regularly check your account statements and transaction history for any unauthorized activity. Report any suspicious transactions immediately.

Use secure networks

Avoid using public Wi-Fi networks for sensitive transactions, as they can be unsecured and vulnerable to eavesdropping. Use a VPN or mobile hotspot instead.

Notify your bank

Inform your bank before traveling and provide them with your itinerary. This will help them monitor your account for unusual activity and assist you in case of an emergency.

Common Travel Card Scams, Travel card 101 test answers

* Skimming:Fraudsters use a device called a skimmer to capture your card information from ATMs or gas pumps. Be wary of suspicious devices attached to card readers.

Phishing

Fraudsters send emails or text messages that appear to come from legitimate sources, asking for your personal information or login credentials. Never share your travel card details through these channels.

Counterfeit cards

Scammers create fake travel cards that may look authentic but are used to steal funds or make fraudulent purchases. Be vigilant when purchasing or accepting travel cards from untrustworthy sources.

FAQ Guide

What is the best travel card for me?

The best travel card for you depends on your individual needs and travel habits. Consider factors such as the types of rewards you want, the fees you’re willing to pay, and the countries you frequently visit.

How can I avoid foreign transaction fees?

Look for travel cards that offer no foreign transaction fees. Some cards may charge a small fee, but it’s typically much lower than the fees charged by banks.

What are the benefits of using a travel card?

Travel cards offer a range of benefits, including rewards points, travel insurance, and access to airport lounges. Some cards also offer exclusive perks and discounts on travel-related purchases.