Mrs roberts has original medicare – Mrs. Roberts has Original Medicare, the government health insurance program for individuals aged 65 and older. This comprehensive guide will delve into the specifics of Mrs. Roberts’ coverage, comparing it to other Medicare options and providing practical tips on managing her benefits effectively.

Original Medicare consists of two parts: Part A, which covers hospital stays, and Part B, which covers medical services like doctor visits and outpatient care. Mrs. Roberts’ coverage under Original Medicare may have certain limitations or exclusions, and understanding these is crucial for optimizing her healthcare experience.

Medicare Basics

Medicare is a federal health insurance program that provides coverage to people who are 65 or older, or who have certain disabilities or end-stage renal disease (ESRD).

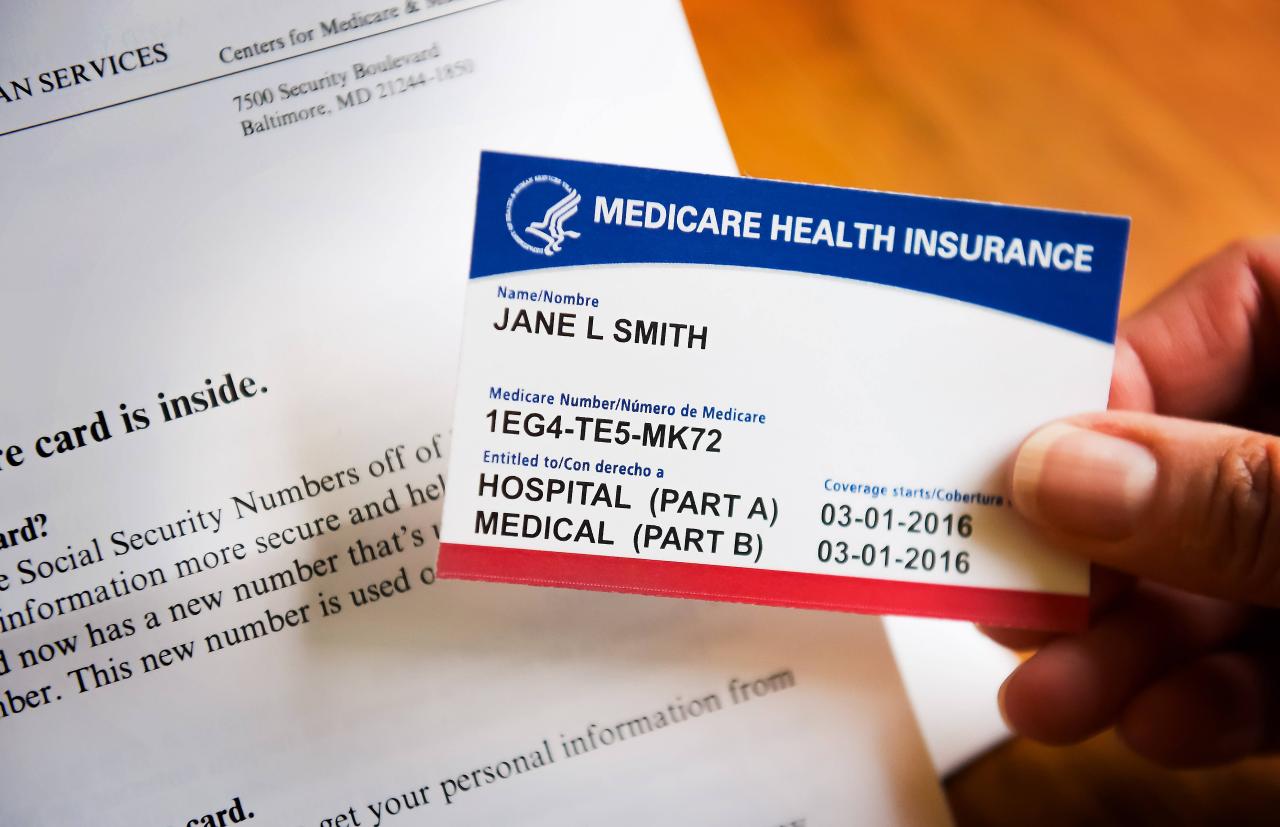

Medicare is divided into four parts: Part A, Part B, Part C, and Part D. Original Medicare includes Part A and Part B. Part A covers hospital care, while Part B covers medical services such as doctor visits, outpatient care, and preventive services.

Eligibility Requirements for Original Medicare

To be eligible for Original Medicare, you must be:

- 65 or older

- A U.S. citizen or permanent resident

- Legally present in the U.S. for at least five years

You may also be eligible for Original Medicare if you have certain disabilities or ESRD.

Parts of Original Medicare

Original Medicare has two parts:

- Part A: Hospital insurance

- Part B: Medical insurance

Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and home health care. Part B covers doctor visits, outpatient care, preventive services, and durable medical equipment.

Mrs. Roberts’ Coverage

Mrs. Roberts has Original Medicare, which is the federal health insurance program for people aged 65 and older, as well as younger people with certain disabilities. Original Medicare consists of two main parts: Part A (hospital insurance) and Part B (medical insurance).

Part A Coverage, Mrs roberts has original medicare

Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care. Specifically, it includes:

- Semi-private hospital room and board

- Skilled nursing facility care

- Home health care

- Hospice care

Part B Coverage

Part B covers medically necessary services and supplies that are not covered by Part A. These include:

- Doctor visits

- Outpatient care

- Durable medical equipment

- Preventive care

- Mental health services

Limitations and Exclusions

It’s important to note that Original Medicare does have some limitations and exclusions. For example, Part A does not cover long-term care, such as nursing home care. Part B does not cover routine dental care, eyeglasses, or hearing aids.

Comparison with Other Medicare Options

Mrs. Roberts currently has Original Medicare, which is the traditional Medicare program. However, there are other Medicare options available that may be a better fit for her needs and budget. In this section, we will compare Original Medicare with other Medicare options, such as Medicare Advantage and Medigap, to help Mrs.

Roberts make an informed decision about her Medicare coverage.

Medicare Advantage (Part C)

Medicare Advantage is a type of Medicare health plan offered by private insurance companies. Medicare Advantage plans typically provide the same benefits as Original Medicare, but they may also offer additional benefits, such as vision, dental, and hearing coverage. Medicare Advantage plans typically have lower out-of-pocket costs than Original Medicare, but they may also have more restrictions on where you can get care.

Advantages of Medicare Advantage

- Lower out-of-pocket costs

- Additional benefits, such as vision, dental, and hearing coverage

- Convenience of having all your Medicare coverage in one plan

Disadvantages of Medicare Advantage

- More restrictions on where you can get care

- May not be available in all areas

- May have higher premiums than Original Medicare

Medigap (Medicare Supplement Insurance)

Medigap is a type of private insurance that helps to cover the out-of-pocket costs of Original Medicare. Medigap plans are standardized, so they offer the same benefits regardless of which insurance company you purchase them from. Medigap plans can be expensive, but they can provide peace of mind by covering the costs that Original Medicare does not.

Advantages of Medigap

- Covers the out-of-pocket costs of Original Medicare

- Standardized benefits, so you know what you’re getting

- Available in all areas

Disadvantages of Medigap

- Can be expensive

- Does not cover all medical expenses

- May not be necessary if you have other insurance, such as employer-sponsored health insurance

Which Option is Right for Mrs. Roberts?

The best Medicare option for Mrs. Roberts will depend on her individual needs and budget. If she is healthy and does not have a lot of medical expenses, she may be able to save money by choosing a Medicare Advantage plan.

If she has a lot of medical expenses, she may want to consider a Medigap plan to help cover the costs that Original Medicare does not. She should also consider her long-term care needs and whether she wants to have the flexibility to see any doctor she wants.

By carefully considering her options, Mrs. Roberts can choose the Medicare plan that is right for her.

Costs and Premiums

Understanding the costs associated with Original Medicare is essential for making informed decisions about healthcare expenses. This section will provide an overview of the premiums, deductibles, and coinsurance that Mrs. Roberts may encounter, along with tips to help reduce her Medicare costs.

Original Medicare consists of two main parts: Part A (hospital insurance) and Part B (medical insurance).

Part A Premiums

Part A premiums are typically paid through payroll taxes while working. However, if Mrs. Roberts is not eligible for premium-free Part A, she may need to pay a monthly premium. The standard Part A premium for 2023 is $299, but higher-income individuals may pay more.

Part B Premiums

Part B premiums are paid monthly to cover medical services, such as doctor visits, outpatient care, and durable medical equipment. The standard Part B premium for 2023 is $164.90. However, Mrs. Roberts’ premium may be higher if she has a higher income.

Deductibles and Coinsurance

In addition to premiums, Mrs. Roberts may also be responsible for deductibles and coinsurance. A deductible is the amount she must pay out-of-pocket before Medicare begins to cover services. The Part A deductible for 2023 is $1,600 per benefit period, while the Part B deductible is $233 per year.

Coinsurance is the percentage of the cost of a covered service that Mrs. Roberts is responsible for paying. For Part A, coinsurance is typically 20% of the Medicare-approved amount for hospital stays, skilled nursing facility care, and hospice care. For Part B, coinsurance varies depending on the service provided.

Tips to Reduce Medicare Costs

- Consider enrolling in a Medicare Advantage plan, which may offer lower premiums and out-of-pocket costs.

- Use generic medications instead of brand-name drugs.

- Get preventive care services, such as screenings and vaccinations, which can help prevent costly illnesses.

- Compare costs for medical equipment and services before making a purchase.

- Take advantage of free or low-cost community resources, such as health clinics and support groups.

Enrolling in Original Medicare: Mrs Roberts Has Original Medicare

Enrolling in Original Medicare is a crucial step to ensure access to essential healthcare coverage. The process involves several steps and deadlines, which can be confusing. This section provides a comprehensive guide to help you navigate the enrollment process.

To enroll in Original Medicare, you must meet certain eligibility criteria, such as being 65 years or older or having a qualifying disability. The enrollment process generally consists of signing up for Part A (hospital insurance) and Part B (medical insurance).

Initial Enrollment Period

The Initial Enrollment Period (IEP) is the seven-month period that begins three months before the month you turn 65 and ends three months after the month you turn 65. During the IEP, you can enroll in Medicare without penalty. If you miss the IEP, you may have to pay a late enrollment penalty for Part B.

Special Enrollment Periods

Special Enrollment Periods (SEPs) are available if you have certain life events, such as losing employer-sponsored health insurance or moving to a new area. SEPs allow you to enroll in Medicare outside of the IEP without penalty.

Resources and Assistance

If you need assistance with enrolling in Original Medicare, you can contact the Social Security Administration (SSA) at 1-800-772-1213 or visit their website at www.ssa.gov/medicare . You can also get help from a Medicare insurance agent or broker.

Managing Original Medicare Coverage

Navigating Original Medicare coverage can be simplified by understanding how to access benefits, file claims, and manage coverage effectively.

Filing Claims

- Online:Use the MyMedicare.gov website to submit claims securely and track their status.

- Mail:Send completed claim forms to the designated Medicare address.

- Phone:Call 1-800-MEDICARE (1-800-633-4227) for assistance in filing claims.

Appealing Denied Claims

- Redetermination:Request a reconsideration of the claim decision within 60 days of receiving the denial.

- Reconsideration:File an appeal within 180 days of the redetermination decision, providing additional documentation or evidence.

- Hearing:If the reconsideration is denied, request a hearing before an administrative law judge.

Managing Coverage Effectively

To optimize Medicare coverage:

- Review coverage regularly:Ensure it meets current needs and consider any changes in health status or medications.

- Stay informed:Access Medicare publications, attend educational events, and consult with healthcare professionals to stay updated on coverage policies.

- Explore supplemental coverage:Consider purchasing a Medicare Supplement or Medicare Advantage plan to cover gaps in Original Medicare.

Quick FAQs

What services are covered under Mrs. Roberts’ Part A?

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and home health services.

What is the monthly premium for Mrs. Roberts’ Part B?

The monthly premium for Part B varies depending on Mrs. Roberts’ income. In 2023, the standard monthly premium is $164.90.

Can Mrs. Roberts enroll in a Medicare Advantage plan instead of Original Medicare?

Yes, Mrs. Roberts can choose to enroll in a Medicare Advantage plan, which offers an alternative way to receive Medicare benefits through private insurance companies.