Embark on a journey to secure your financial future with Investing for Retirement Sim Answers. This comprehensive guide unravels the complexities of retirement planning, providing invaluable insights and strategies to help you navigate the path towards a comfortable retirement.

Discover the intricacies of investment options, retirement planning strategies, risk tolerance, and income planning. Our expert guidance empowers you to make informed decisions, optimize your savings, and achieve financial independence in your golden years.

Investment Options for Retirement

Retirement planning involves making wise investment decisions to secure financial stability during retirement years. Various investment accounts are available, each with unique benefits and drawbacks, catering to specific financial goals and circumstances.

401(k) Plans

- Employer-sponsored retirement plans that allow employees to contribute a portion of their salary on a pre-tax basis.

- Contributions reduce current taxable income, resulting in potential tax savings.

- Earnings grow tax-deferred until withdrawn during retirement, potentially leading to substantial tax savings.

- Employer may match contributions, providing additional retirement savings.

- Withdrawals before age 59½ may incur penalties and taxes.

Individual Retirement Accounts (IRAs)

- Personal retirement accounts established by individuals, regardless of employment status.

- Two main types: Traditional IRAs and Roth IRAs.

- Traditional IRAs offer tax-deductible contributions, but withdrawals are taxed as ordinary income.

- Roth IRAs allow for after-tax contributions, but qualified withdrawals are tax-free.

- Income limits apply for both Traditional and Roth IRAs.

Roth IRAs

- A type of IRA that allows for after-tax contributions.

- Qualified withdrawals are tax-free, including both contributions and earnings.

- No income limits for contributions, but income limits apply for Roth conversions.

- Withdrawals before age 59½ may incur penalties and taxes, except for certain exceptions.

Investment Products for Retirement Accounts

Within these retirement accounts, individuals can invest in a range of products, including:

- Stocks: Represent ownership in publicly traded companies, offering potential for growth and dividends.

- Bonds: Loans made to governments or corporations, providing fixed interest payments and principal repayment.

- Mutual Funds: Diversified portfolios of stocks, bonds, or other assets, managed by professional investment managers.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like stocks.

- Real Estate: Investing in properties can provide rental income and potential appreciation.

Choosing the right investment options for retirement depends on individual circumstances, risk tolerance, and financial goals. It is recommended to consult with a financial advisor to determine the most suitable strategy.

Retirement Planning Strategies: Investing For Retirement Sim Answers

Retirement planning is the process of determining how much money you will need to retire comfortably and then developing a strategy to save and invest that money. There are many different retirement planning strategies, but they all involve the following steps:

- Setting retirement goals

- Developing an investment strategy

- Saving and investing money

- Monitoring your progress

- Adjusting your strategy as needed

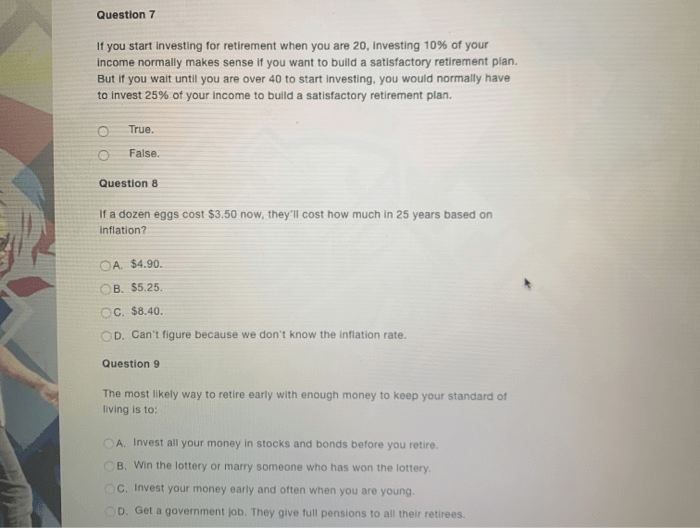

One of the most important steps in retirement planning is setting retirement goals. What do you want to do in retirement? How much money will you need to live the lifestyle you want? Once you know your goals, you can develop an investment strategy that will help you reach them.Diversification

is an important part of any retirement investment strategy. Diversification means investing in a variety of different assets, such as stocks, bonds, and real estate. This helps to reduce the risk of losing money in any one investment.There are many different ways to calculate your retirement savings needs.

One common method is to use a retirement calculator. These calculators can be found online or through financial advisors. Retirement calculators can help you estimate how much money you will need to save each month to reach your retirement goals.Retirement

planning is an important part of financial planning. By taking the time to plan for retirement, you can increase your chances of having a secure and comfortable retirement.

Risk Tolerance and Retirement Investing

Risk tolerance is a crucial factor that influences investment decisions, especially in the context of retirement planning. It refers to an individual’s willingness and ability to withstand potential losses in their investment portfolio.

Several factors can affect risk tolerance, including age, income, investment goals, and personal circumstances. Younger individuals with a longer investment horizon may have a higher risk tolerance as they have more time to recover from potential losses. Individuals with higher incomes may also have a higher risk tolerance as they can afford to take on more risk in pursuit of higher returns.

Strategies for Managing Risk in a Retirement Portfolio

There are several strategies that individuals can employ to manage risk in their retirement portfolio:

- Diversification:Spreading investments across different asset classes, such as stocks, bonds, and real estate, can help reduce overall portfolio risk.

- Asset Allocation:Determining the appropriate mix of asset classes based on risk tolerance and investment goals is essential for risk management.

- Rebalancing:Periodically adjusting the asset allocation to maintain the desired risk level is crucial, especially during market fluctuations.

- Dollar-Cost Averaging:Investing a fixed amount of money at regular intervals, regardless of market conditions, can help reduce the impact of market volatility.

- Consideration of Guaranteed Income Sources:Incorporating sources of guaranteed income, such as annuities or pensions, into the retirement portfolio can provide a safety net and reduce overall risk.

Retirement Income Planning

Retirement income planning involves creating a strategy to generate a sustainable income stream during retirement. This income can come from various sources, including Social Security, pensions, and investments.

Creating a sustainable income stream is crucial to maintain financial stability and independence during retirement. Factors to consider include expenses, inflation, and life expectancy.

Maximizing Retirement Income, Investing for retirement sim answers

- Maximize Social Security Benefits:Claiming benefits at the optimal age and working longer can increase benefits.

- Plan for Pensions:If eligible, understand the different types of pensions and their benefits.

- Invest Wisely:Diversify investments and consider a mix of stocks, bonds, and real estate to generate income and growth.

- Consider Annuities:Annuities provide a guaranteed income stream for life, but may have drawbacks such as surrender charges.

- Downsize or Relocate:Reducing housing expenses or moving to a more affordable location can free up funds for retirement.

Expert Answers

What are the different types of retirement accounts available?

There are several types of retirement accounts available, including 401(k)s, IRAs, and Roth IRAs. Each type offers unique benefits and drawbacks, so it’s important to understand the differences before choosing the right one for your needs.

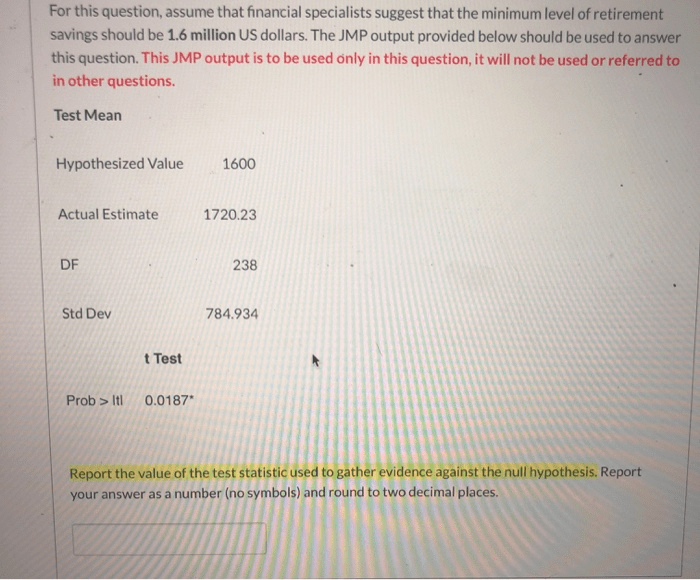

How can I calculate my retirement savings needs?

There are several methods to calculate your retirement savings needs. One common approach is to use a retirement calculator, which takes into account factors such as your age, income, and desired retirement age.

What is risk tolerance and how does it affect investment decisions?

Risk tolerance refers to your ability to withstand potential losses in your investments. It is an important factor to consider when making investment decisions, as it can help you determine the appropriate level of risk for your portfolio.